May 4, 2012: Members have just more than 3 accounts on average at their main financial institution, and pay just over $12 on average in monthly fees

The majority say their main financial institution offers a no-frills, no-fee basic account suitable for seniors, almost all agree it is important such accounts should be offered, that they would be more likely to do business with an institution offering this kind of account and that it should be offered automatically to seniors

Two thirds think bank fees are too high, and the majority would switch banks to get better rates.

Three quarters use financial advisors and half of those who do say their advisor is a Certified Financial Planner, or CFP. Reputation of the firm and referral from friends or family are the most important factors in choosing an advisor

Half think a professional designation improves trust in an advisor, that an advisor would lose this designation for misdeeds, and two thirds say they understand the meaning of their advisor’s designation.

Members agree ‘captive agents’ (employees of one financial institution, who sell only that company’s products) shouldn’t be called financial advisors, agree they would go to the police in the case of an advisor misdeed and that advisors are not all held to the same standards and practices

One half agree there are too many financial advisor designations and that the federal government should regulate financial advisors.

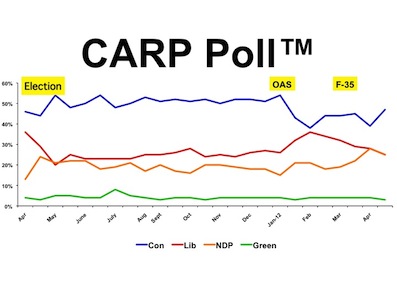

The Conservatives have recovered from the decline they suffered post-OAS and F-35, and the Liberals and NDP remain tied in second place.

To download a full copy of the report, please click here.

TCPTG12345