What Do I Need to Know About Pension Protection in Canada?

Time and time again CARP members tell us that financial security is their #1 concern. Pension Protection is a concern for older Canadians and priority for CARP in a number of ways:

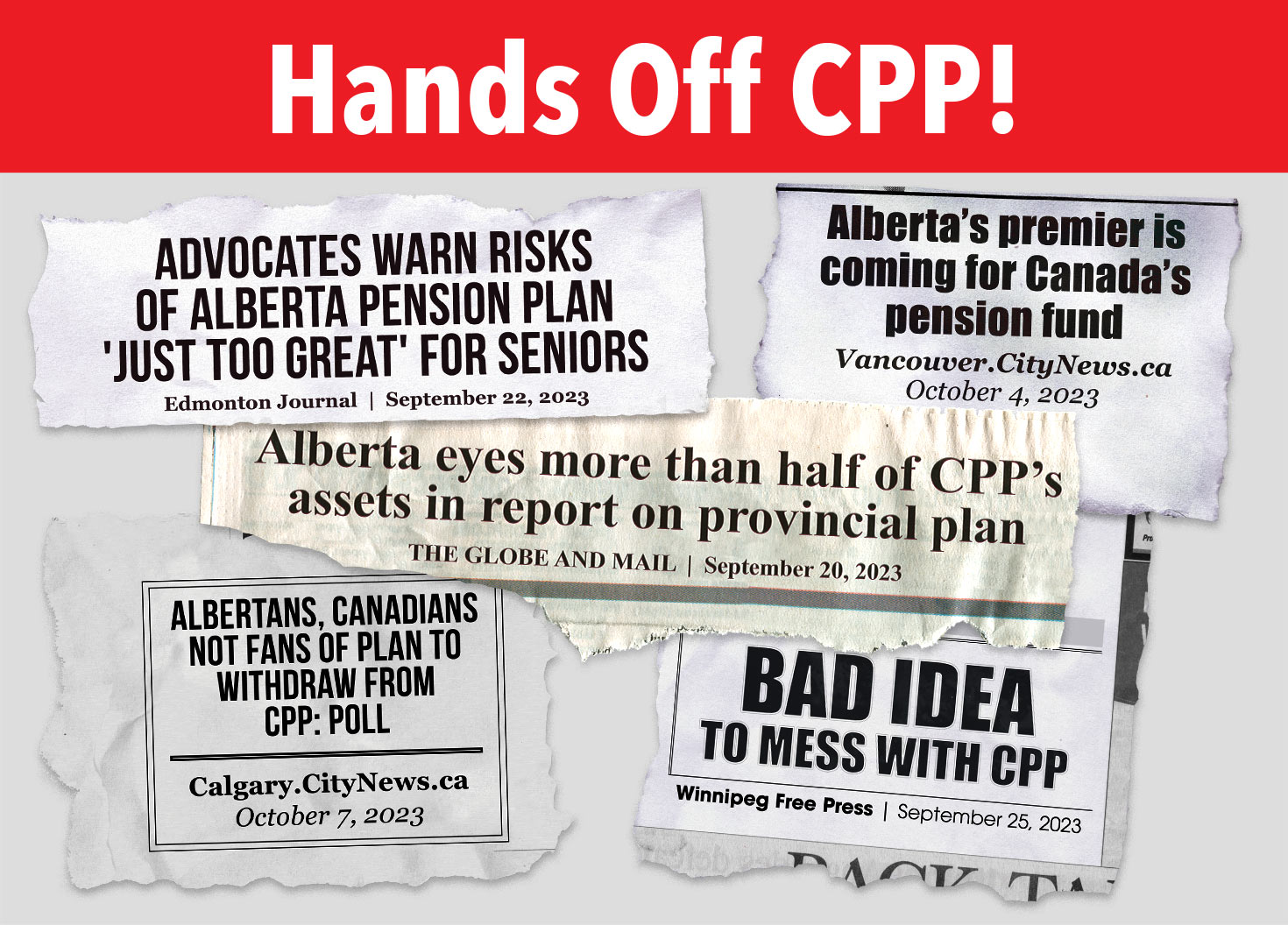

1 – Canada Pension Plan – In 2023, Alberta began discussing a potential interest in withdrawing from the Canada Pension Plan, placing the integrity of the CPP at risk.

2- Pension Protection/Super Priority Status – Until 2023, the law dictated that when companies go bankrupt the assets of the failed company were divided and banks are paid first. The unexpected loss of income from an incomplete pension plunged vulnerable seniors into poverty.

1. Canada Pension Plan

The CPP provides a foundational retirement income for most working Canadians. It is one of our country’s most important and most invaluable public policy achievements. It speaks to our shared values, provides vital support to our seniors and is envied around the world. Not only has the CPP served us well, but repeated reviews have found it is sustainable for generations to come.

In 2023, the province of Alberta discussed potential withdrawal from CPP. This would have huge impacts on retirees all across the country.

In early winter of 2023, CARP wrote to Finance Ministers to demand an unequivocal stance in support of a united CPP. Read the letter.

While the government acknowledged the importance of the CPP to all Canadians, a discussed next step was a study of how much of the CPP funds the province of Alberta could potentially transition to their own plan. CARP believes strongly this is the wrong move for Canadians, particularly older Canadians.

The only path and the one we should take is the defence of the unity of the CPP for this generation and every generation to come.

You can read more about the issue related to Alberta’s potential withdrawal from CPP here.

Stay tuned as CARP continues to fight for a unified CPP.

2. Pension Plan/Super Priority Status

CARP has advocated for pension protection for twenty years. In recent years, this issue has gained traction and CARP and allies’ dogged advocacy has paid off.

Pensions are deferred wages, earned while Canadians are working and paid after they retire. CARP and allies have argued for years that pensioners and active plan members deserve the full pension that they have earned and their employers committed to. Pensioners should not be collateral damage in insolvency.

- The risk to defined benefit pensions occurs when a company becomes insolvent and its pension is underfunded.

- Without this recent legislation, when companies were in trouble but hadn’t yet become insolvent, pensioners were powerless to intervene and secure their pensions. All other creditors could negotiate terms to protect their interests.

- An estimated 78% of defined benefit pension plans in Ontario are underfunded. In the event of an insolvency, prior to this legislation, these pensioners would not receive their full pension. This put an estimated 850,000 pensioners at risk. (FSCO 2018)

Time and time again CARP members tell us that financial security is their #1 concern. Pension protection is a concrete way to effect real change for seniors at no cost to taxpayers.

How is CARP Advocating?

In the spring of 2022, CARP joined advocates including the Canadian Federation of Pensioners and Canadian Network for the Prevention of Elder Abuse in writing an open letter to the government, urging them to step up and protect vulnerable pensioners. Read the letter.

Canada lags behind other similar countries in pension protection.

In early 2022, a private members bill, Bill C-228 was introduced and has since been approved by the house and senate. Now government has to make it legislation and the details of its implementation determined.The bill, if implemented well, will protect the 4.6 million Canadian seniors and their families who rely on defined benefit pensions for their financial security in retirement.

CARP’s demands of government

- Create a pension insurance program that insures 100% of the pension liability.

- Amend insolvency legislation to extend super-priority to the unfunded pension liability.

- Commission a third-party study to explore alternative legislative and regulatory solutions that will ensure pensioners receive 100% of their pensions in the event of corporate insolvency.

How Can I Get involved?

There are many ways to get involved. Find out more.